Labour’s Luxury Dilemma: The Tax Challenge Facing Keir Starmer

The political arena is once again in a tizzy as revelations surrounding Prime Minister Sir Keir Starmer’s recent clothing donations have sparked calls for a shift in how gifts to public officials are treated for tax purposes. It seems that an eye-watering £32,000 worth of apparel gifted from Labour peer Lord Alli has thrown the opposition party into hot water, raising serious questions about transparency and privilege in politics.

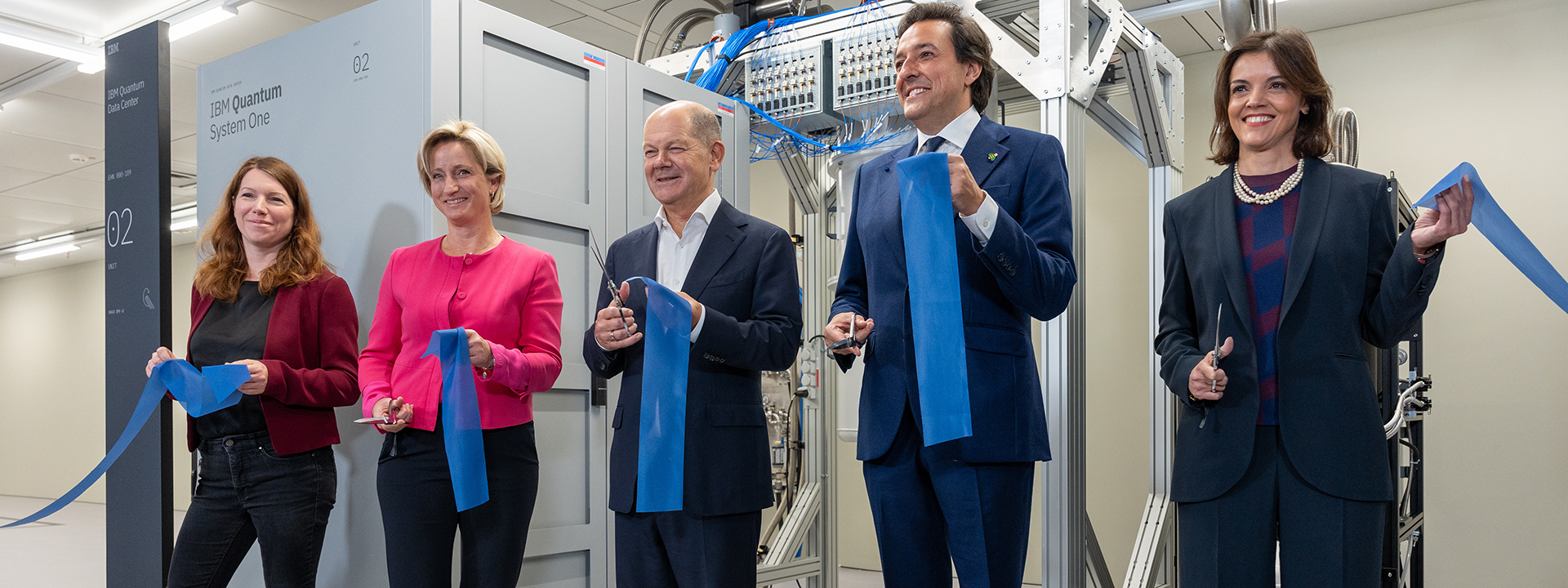

A glimpse into the lavish lifestyle that could come under scrutiny.

A glimpse into the lavish lifestyle that could come under scrutiny.

The Gift that Keeps on Giving

This unexpected windfall, while perhaps a boon for Starmer’s wardrobe, has ruffled feathers within his party. Amid a chorus of dissent, some party members have pointed out the “breathtaking level of naivety” in accepting such substantial donations, especially in a climate where trust in politicians is at a premium. One MP remarked, “If this had been a Tory prime minister, he and his Chancellor would have been the first to call for an investigation.”

The pressure is mounting, with campaigners advocating for stricter laws that would classify such donations as taxable income. Sir Gavin Williamson, a former Defence Secretary, has taken the initiative to pen a letter to the Chancellor, questioning whether the clothing donations constitute a “taxable benefit in kind.”

Matters get murkier when we consider that transparency is not just a matter of proper conduct but also a constitutional necessity for democratic leadership. Claire Aston, director of TaxWatch, notes, “It is especially important for politicians to declare and pay taxes on any gifts received, and the law should be clarified to ensure there is consistency of treatment and to avoid confusion.”

The Hypocrisy of Politics

As the Labour party positions itself as a bastion of fairness, it must reckon with the optics of Starmer’s luxury clothing donations. Critics argue that the party’s actions do not align with its rhetoric, asserting that the elite lifestyle of its leaders undermines its mission to advocate for the working class. Starmer has already made headlines for repaying £6,000 worth of hospitality and gifts since assuming office, yet the £32,000 clothing gift represents a stark departure from the image Labour seeks to project.

Meanwhile, the broader implications of this scandal resonate beyond Starmer’s closet. The Lords standards watchdog is currently investigating Lord Alli for alleged breaches of conduct, leading to increased scrutiny over donations across the political landscape. The call for an overhaul of the tax exemptions afforded to politicians is growing stronger, as Matt Crawford from Blick Rothenberg argues that gifts related to a public official’s duties should be subject to taxation, provided a sensible threshold is established.

A Broader Context: John Kerry’s Tax Breaks

In a driving parallel, the luxurious lifestyle of former presidential candidate John Kerry has also come into focus. With a $17 million home in Boston, Kerry finds himself on the receiving end of a proposed $22,721 tax break under Mayor Michelle Wu’s plan to redistribute the city’s tax responsibilities more heavily onto commercial properties. This contrasts sharply with the plight of average citizens who are desperately seeking tax relief amid rising living costs. As public outcry intensifies, the conduct of high-profile politicians like Kerry and Starmer continues to face scrutiny for their perceived detachment from the everyday realities experienced by their constituents.

John Kerry’s $17 million residence may soon benefit from significant tax breaks.

John Kerry’s $17 million residence may soon benefit from significant tax breaks.

Transparency and the Future of Political Donations

Amid these controversies, the overarching narrative draws attention to the necessity for reform concerning how political gifts and donations are regulated. David Portman, a tax partner, warns that the current tax status of gifts is “ambiguous,” raising concerns about accountability and the potential exploitation of the system. The political arena is rife with contradictions; politicians call for transparency from one another while navigating their privileges with apparent ease.

As the conversation accelerates towards a clear cut regulatory change, citizens are right to demand transparency from their leaders. The moral responsibility is heavy; as public officials navigate the complexities of their financial dealings, the expectations grow heavier. Each clothing donation, each extravagant tax break, draws attention to the broader issue of whether political figures are truly in touch with the lives of those they represent.

Conclusion: What Lies Ahead for Politicians Under Scrutiny

As Labour embarks on its journey back to power, the party must confront these challenges head-on, lest its aspirations be overshadowed by allegations of hypocrisy. The questions surrounding tax-related gifts and transparency are not just about the lives of these politicians; they reverberate through the very fabric of democracy itself. In doing so, leaders like Starmer and initiatives aimed at transforming social welfare must align with the voices of those they aim to serve.

A moment of reflection in a tumultuous political landscape.

A moment of reflection in a tumultuous political landscape.

In the ongoing saga of political fineries and their economic implications, one truth remains unequivocal: the call for action is louder than ever. Will our political leaders heed the warning, or will they continue to wear their conceits with as much pride as their tailor-made suits?

Photo by

Photo by