Transnet Seeks Debt Relief Amid Struggles with Freight Rail and Port Services

South Africa’s state-owned logistics firm, Transnet, is appealing for government debt relief amid pressing financial struggles. The company, burdened by 130 billion rand ($7.30 billion) in debt, is striving to restore operational efficiency in its freight rail and port services hampered by outdated equipment and maintenance backlogs.

The debt burden is attributed to past corrupt procurement deals, including the ‘state capture’ scandal that marred the nation under former President Jacob Zuma, costing billions. Transnet Chairman Andile Sangqu noted that efforts to boost freight volumes have been undermined by significant debt servicing costs, with freight volumes dropping from 226 million metric tons in 2017/18 to 152 million in 2023/24.

Supercommuting CEOs: A Growing Trend

In a similar vein, CEOs of large corporations are increasingly demanding flexibility in their work arrangements. Brian Niccol, the newly appointed CEO of Starbucks, has negotiated a deal that allows him to live in his home in Newport Beach, California, and commute to Starbucks’ head office in Seattle on a corporate jet. This arrangement underscores the gulf in bargaining power between high-ranking executives and the average employee.

According to Raj Choudhury, a professor at Harvard Business School, the supercommuting CEO is becoming ‘increasingly common’ due to the competitive labor market. Choudhury notes that executives are no longer accepting job offers without flexibility, and companies are making exceptions to attract and retain top talent.

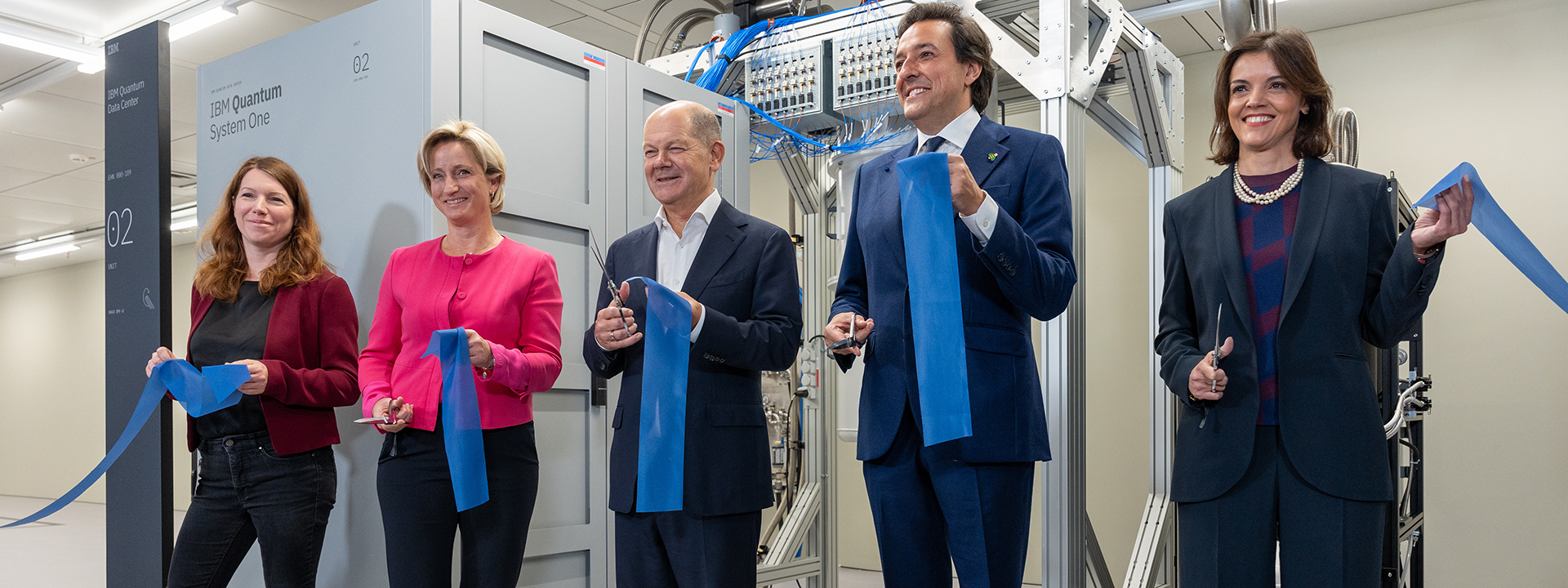

Image: A CEO commuting to work on a corporate jet

The Impact of State Capture on South Africa’s Economy

The state capture scandal has had far-reaching consequences for South Africa’s economy, including the financial struggles faced by Transnet. The scandal, which involved corrupt procurement deals and mismanagement of state-owned enterprises, has led to a decline in investor confidence and a rise in unemployment.

Image: A protest against state capture in South Africa

Conclusion

The struggles faced by Transnet are a microcosm of the larger economic challenges faced by South Africa. The company’s debt burden, attributed to past corrupt procurement deals, highlights the need for good governance and transparent management of state-owned enterprises.

As the country seeks to revitalize its economy, it is essential to address the underlying issues that led to the state capture scandal. This includes implementing measures to prevent corruption, improving governance, and promoting transparency in state-owned enterprises.

Image: A visual representation of the South African economy

The supercommuting CEOs, on the other hand, represent a growing trend in the corporate world. As companies compete for top talent, they are making exceptions to offer flexibility and attractive compensation packages.

Whether it’s the struggles of Transnet or the flexibilities offered to CEOs, these stories highlight the complexities of the modern economy. As we navigate these complexities, it’s essential to remember that good governance, transparency, and accountability are essential for economic growth and development.

Image: A visual representation of the corporate world

Photo by

Photo by